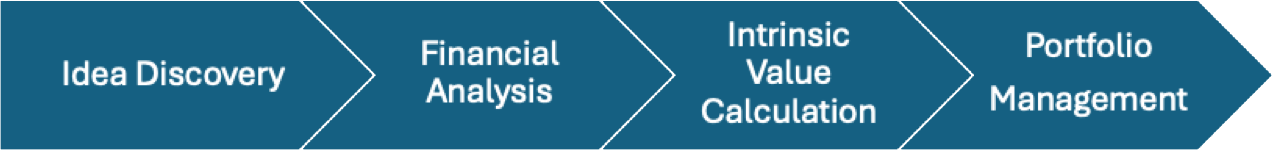

Investment Process

Summary

The Business Valuation Model (BVM) seeks capital appreciation through a value-driven equity strategy.

From a broad universe of companies, we apply a rigorous screening process to identify potential candidates which have been consistently profitable, growing, and well-capitalized. During the due diligence process we consider qualitative aspects, including industry dynamics, competitive forces, and management competency. Targeted companies are subjected to a detailed financial analysis and quantitative valuation process to establish a reasonable estimate of intrinsic value. When fully invested, the portfolio seeks to invest in 20–30 companies with certain financial characteristics—consistent and profitable growth, high returns on capital, strong free cash flow, and a low organic need for external financing. We look to buy these companies at attractive valuations to strengthen our investment strategies. A typical position size in the portfolio is generally at 4%. In situations where we are unable to find investments that meet our criteria, we may seek opportunities elsewhere or hold cash as appropriate. We will sell a security if the price moves beyond our assessment of value, long-run fundamental prospects decline, or if the balance sheet becomes excessively risky. We will continue to hold a security if the company's earnings power and our assessment of value rises ahead of the stock price.

Strong Financials

We seek candidates which have demonstrated consistent profitability while employing low levels of debt. Therefore, we focus on businesses with consistent free cash flow, return on equity, and return on invested capital.

Competent Management

Portfolio candidates should be run by competent management with the proven ability to allocate capital. We seek businesses with management which are shareholder-oriented and properly incentivized.

Attractively Valued

Candidate companies should trade at a significant discount to our estimate of intrinsic value under a set of conservative assumptions. We hope to establish a "margin of safety" that helps us to avoid unnecessary risk without sacrificing returns. Alternatively, where valuations do not reflect underlying risk, the portfolio may hold cash.